Understanding the Power of Compound Interest

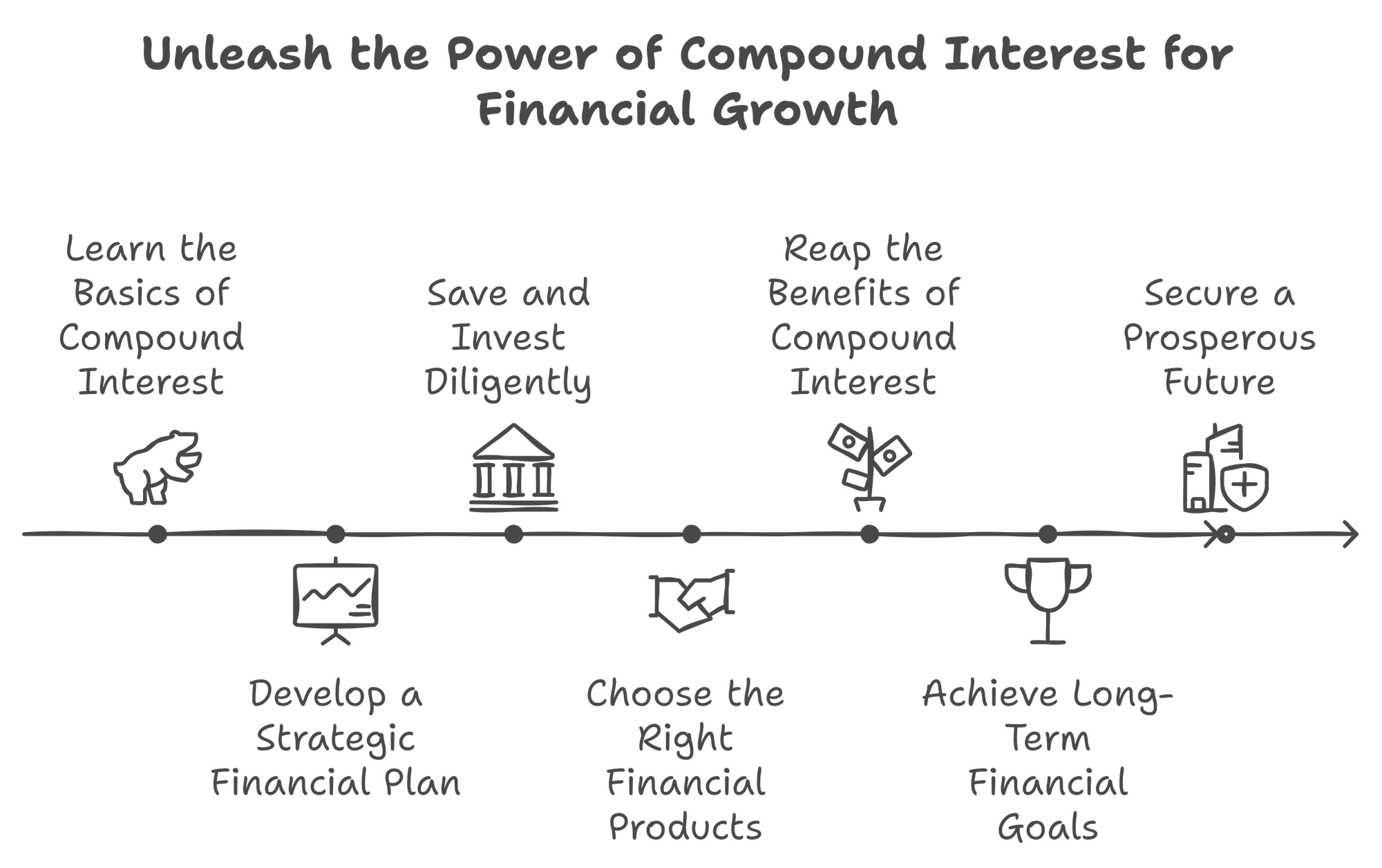

Unlock the transformative power of compound interest. Grow your wealth exponentially over time through strategic savings and informed investment decisions.

Compound interest, often referred to as the eighth wonder of the world, is a financial principle that has the transformative power to grow your wealth exponentially over time. At its core, compound interest is the process where the interest you earn on a principal amount is reinvested to generate additional earnings.

This cycle of earning interest on both the original principal and the accumulated interest can lead to substantial growth, making it a crucial concept for anyone looking to build their financial future. To truly appreciate the potency of compound interest, it's essential to compare it to simple interest. While simple interest is calculated solely on the principal amount, compound interest includes interest earned on previous interest payments.

Think of it like a snowball rolling down a hill: as it rolls, it picks up more snow and grows larger at an accelerating rate. Similarly, with compound interest, your wealth snowballs, growing more quickly as time passes. Understanding compound interest is pivotal not just for your personal savings, but also for making informed investment decisions. Whether you're saving for retirement, building an emergency fund, or investing in the stock market, the principles of compound interest can significantly influence your financial success.

By harnessing the power of compounding, individuals can optimize their investment returns and achieve their financial goals more efficiently. In essence, compound interest isn't just a financial concept; it's a powerful strategy that can turn modest savings into a significant nest egg over time.

By grasping the fundamentals of how compound interest works and implementing strategic practices to maximize its potential, you can pave the way for a secure and prosperous financial future.

Introduction to Compound Interest

When it comes to growing your wealth, few financial concepts are as powerful as compound interest. Imagine you plant a tree. Every year it grows a few new branches, and those branches, in turn, grow their own branches. As years pass, the tree doesn't just grow taller; it grows exponentially more complex and expansive. This imagery aptly encapsulates what compound interest does to your money.

At its core, compound interest is interest calculated on the initial principal, which also includes all the accumulated interest from previous periods on a deposit or loan. This might sound like financial jargon, but let's break it down.

Unlike simple interest, which is calculated only on the principal amount, compound interest adds a snowball effect by including interest in subsequent calculations. It's akin to rolling a snowball downhill; the further it rolls, the larger it becomes because it keeps accumulating more snow.

Understanding the difference between simple interest and compound interest is crucial. Simple interest can be likened to earning a fixed salary - predictable but limited. For example, if you invested $1,000 at an annual simple interest rate of 5% for three years, you'd earn $50 every year, totaling $150.

In contrast, compound interest is like joining a profit-sharing scheme where your earnings grow rapidly over time. With the same $1,000 and 5% annual compound interest, after three years, you'd earn approximately $157.63. While the initial extra $7.63 might seem negligible, over extended periods, the difference balloons substantially.

The Compound Interest Formula

To fully grasp the might of compound interest, a basic understanding of its formula is essential. The formula to calculate the compound interest is:

A = P(1 + r/n)^(nt)

In this equation:

- A stands for the amount of money accumulated after n periods, including interest.

- P represents the principal amount (the initial sum of money).

- r is the annual nominal interest rate (as a decimal).

- n denotes the number of times the interest is compounded per year.

- t is the time the money is invested or borrowed for, in years.

For instance, if you invest $1,000 at a 5% annual interest rate compounded annually for 3 years, the formula would look like this: A = 1000(1 + 0.05/1)^(1 * 3). Plugging in the values, you’d get A = 1,000(1.05)^3, which results in approximately $1,157.63.

The Compounding Effect Over Time

The true power of compound interest shines when applied over a long period. It's the financial equivalent of planting a seed that grows into a forest. For example, if a college student invested $5,000 today at an annual compound interest rate of 7% and left it untouched for 40 years, it would grow to around $74,872. Compare that to investing the same amount in an account with simple interest - the difference would be staggering.

But the magic of compound interest isn't restricted to lengthy periods. Understanding it can significantly impact personal and financial decisions, especially those related to savings and investments.

Knowing how compound interest works can help individuals make more informed choices, maximize their returns, and work towards financial independence. It's like being handed a map to financial growth, highlighting the paths that lead to the most abundant destinations.

Google Search, Compound Interest, and You

The internet is teeming with resources detailing the importance of compound interest, but not all information you find may be accurate or helpful. Searching for compound interest might lead you to various calculators, investment guides, and financial theories.

The key is to navigate these resources with a clear understanding of the underlying principles. Recognizing the stark differences between simple and compound interest can steer you away from investments that seem lucrative on the surface but offer limited growth potential.

As you investigate deeper into the world of finance and investments, mastering compound interest is indispensable. It serves as the cornerstone for wealth accumulation, influencing everything from retirement plans to education funds. By internalizing its mechanics and implications, you're better equipped to harness its full potential and make decisions that can profoundly influence your financial future.

In summary, compound interest is not just a mathematical formula; it's a robust tool that can significantly amplify your wealth over time. Whether you're a seasoned investor or just starting on your financial journey, understanding and applying the principles of compound interest can pave the way for greater financial stability and growth.

Like the ever-growing tree, your investments will flourish, generating returns that compound to build a brighter, more prosperous future.

The Mechanics of Compound Interest

At its core, compound interest is a financial concept that enables money to grow exponentially over time. This powerful mechanism is akin to planting a tree that, year after year, not only grows taller but also sprouts new branches that continue to grow. To truly appreciate the profound impact compound interest can have on personal finances, it is crucial to understand how it works.

How Compound Interest Works

Compound interest is the interest on a loan or deposit that is calculated based on both the initial principal and the accumulated interest from previous periods. In simpler terms, it means earning interest on interest, which accelerates the growth of your investment or savings over time. This compounding effect can significantly enhance wealth accumulation, provided you give it enough time to work its magic.

Formula for Calculating Compound Interest

The formula for compound interest can look intimidating at first glance, but breaking it down step by step can simplify it. Here’s the standard formula:

A = P (1 + r/n)^(nt)

Where:

- A = the amount of money accumulated after n periods, including interest.

- P = the principal amount (the initial amount of money).

- r = annual interest rate (in decimal).

- n = number of times the interest is compounded per year.

- t = the number of years the money is invested or borrowed for.

For example, let’s calculate how much $1,000 will grow in 5 years with an annual interest rate of 5% compounded annually.

Using the formula:

P = $1,000

r = 0.05

n = 1

t = 5

A = 1000 (1 + 0.05/1)^(1*5) = 1000 (1.05)^5 ≈ $1,276.28

After 5 years, $1,000 would grow to approximately $1,276.28, thanks to the power of compound interest. Each year, the interest earns additional interest, thereby creating a snowball effect.

Factors Affecting Compound Interest

Several key factors influence how compound interest accumulates. Understanding these variables can empower you to make better financial decisions.

Principal Amount (P)

The principal amount is the initial sum of money invested or borrowed. In our example, this was the $1,000. Naturally, the larger the principal, the more interest it can generate. Think of it like a seed in a garden; a larger seed has the potential to grow into a more substantial plant.

Interest Rate (r)

The interest rate is the percentage at which your money grows annually. A higher interest rate will lead to more substantial growth. For instance, if the rate were increased from 5% to 6%, the total amount after 5 years would be higher, demonstrating the importance of securing the best possible rate.

Using the formula with a 6% interest rate:

P = $1,000

r = 0.06

n = 1

t = 5

A = 1000 (1 + 0.06/1)^(1*5) = 1000 (1.06)^5 ≈ $1,338.23

As seen, an increase in the interest rate to 6% would grow the amount to approximately $1,338.23 after five years.

Compounding Frequency (n)

The compounding frequency refers to how often the interest is calculated and added to the principal. Common frequencies include annually, semi-annually, quarterly, monthly, and daily compounding. The more frequently the interest compounds, the more significant the growth. Imagine a snowball rolling down a hill; the more times it rolls, the larger it becomes.

Calculate for monthly compounding (n=12):

P = $1,000

r = 0.05

n = 12

t = 5

A = 1000 (1 + 0.05/12)^(12*5) ≈ $1,283.36

With monthly compounding, the amount grows to approximately $1,283.36 after five years, which is more than with annual compounding.

Time (t)

Time is perhaps the most critical element in the equation. The longer your money is allowed to compound, the more powerful the effect becomes. Essentially, time acts as a multiplier in the compounding process, akin to how age strengthens the roots of a tree, enabling it to grow more robustly.

Consider the same principal of $1,000 with a 5% annual interest rate compounded annually for 10 years, rather than 5:

Using the formula with t=10:

P = $1,000

r = 0.05

n = 1

t = 10

A = 1000 (1.05)^10 ≈ $1,628.89

After 10 years, the amount grows to approximately $1,628.89, showcasing the significant impact of time on compound interest.

Benefits and Strategies for Maximizing Compound Interest

The benefits of compound interest stretch far beyond simple monetary gains, reaching into the realms of financial security and wealth accumulation. Imagine you are planting a tree. In its infancy, it is small and unimpressive.

However, with each passing year, it grows not linearly but exponentially, branching out and producing fruit. This analogy succinctly captures the essence of compound interest. When left to its own devices, it can turn modest beginnings into substantial endings.

Long-term Benefits of Compound Interest for Savings and Investments

When considering savings and investments, one of the most compelling advantages of compound interest lies in its ability to accelerate growth over time. This growth can be distilled into two fundamental points:

- Exponential Growth: The beauty of compounding lies in its exponential nature. Money grows at an increasing rate over time, provided the interest earned gets reinvested. Just as a snowball rolling down a hill accumulates more snow and gains speed, the principal amount in an account increases as interest accrues, which in turn earns more interest.

- Time Leverage: Time is the most potent ally of compound interest. The longer the period over which money is invested, the more dramatic the growth. For example, investing $1,000 at an annual interest rate of 5% will yield $1,628 after ten years, but a startling $4,322 after twenty years. Thus, the longer the money remains invested, the greater the returns.

These benefits cumulatively make compound interest a cornerstone for long-term financial planning, encouraging early and sustained investments for the best results.

Effective Strategies for Maximizing Earnings Through Compound Interest

Maximizing the benefits of compound interest is not simply a matter of parking money in any account and waiting for magic to happen. It requires strategic planning and execution. Here are several strategies to get the most out of this powerful financial tool:

1. Start Early and Be Consistent

The sooner you begin saving or investing, the more time compound interest has to work its magic. Consider two individuals: Alice starts saving $200 a month at the age of 25, while Bob, who begins at 35, saves the same amount.

Assuming both get an annual return of 7%, Alice will have garnered nearly double the amount by the time they both reach retirement age. Consistency is key here; regularly investing small amounts can yield considerable returns over time.

2. Reinvest Your Earnings

To benefit fully from compound interest, it is crucial to consistently reinvest earnings rather than withdrawing them. Each reinvestment increases the principal, thereby generating higher interest in subsequent periods. This cycle, often referred to as compounding within compounding, supercharges growth rates.

3. Opt for Higher Compounding Frequencies

Compounding frequency—how often interest is added to the principal—plays a significant role in maximizing returns. Interest can be compounded annually, semi-annually, quarterly, monthly, or even daily.

The more frequent the compounding, the higher the returns. For example, compounding interest monthly rather than annually can yield significantly higher returns, as interest is calculated and added to the principal more often.

4. Stay Invested for the Long Term

The temptation to cash out investments for immediate needs is ever-present, but patience pays off in maximizing compound interest. Opting for long-term investment accounts or retirement funds usually results in significantly higher returns due to the prolonged period of compounding.

Holding investments like stocks, bonds, and mutual funds for extended periods also allows time to recover from market volatility.

5. Utilize Tax-Advantaged Accounts

One of the downsides to compound interest earnings can be the taxes levied on them. Utilizing tax-advantaged accounts such as IRAs, 401(k)s, and Roth IRAs can mitigate this issue.

These accounts often offer tax-deferral or tax-exemption benefits, allowing the compound interest to grow unhindered by yearly taxes, which can further accelerate wealth accumulation.

Tips for Choosing the Right Financial Products or Investment Vehicles That Utilize Compound Interest

Selecting the right financial products and investment vehicles that best utilize compound interest requires a blend of research, risk tolerance assessment, and alignment with financial goals. Here are some guidelines:

1. High-Yield Savings Accounts

For individuals with low-risk tolerance, high-yield savings accounts offer a secure avenue for tapping into compound interest. These accounts typically offer higher interest rates compared to standard savings accounts, and the interest compounds daily or monthly.

2. Certificates of Deposit (CDs)

CDs offer another low-risk option where money is locked for a specific term at a fixed interest rate. While less liquid, they generally offer higher interest rates than regular savings accounts, with interest compounding over the term.

3. Stock Market Investments

For those comfortable with higher risk, stock investments provide significant compound interest potential. Dividends from stocks can be reinvested to purchase more shares, compounding the investment. However, market volatility means that long-term horizons and diversified portfolios mitigate risks and maximize returns.

4. Mutual Funds and ETFs

Mutual funds and ETFs offer diversification and professional management, which can be essential for maximizing compound interest. Choosing funds with good track records and low fees ensures that more money stays invested, enhancing compounding effects.

In summary, understanding and leveraging compound interest effectively requires a combination of strategic planning, disciplined saving and investing, and selecting appropriate financial products. By starting early, reinvesting earnings, and staying invested long-term, individuals can harness the full power of compound interest to achieve substantial financial growth.

Compound interest, often described as the eighth wonder of the world, is a fundamental financial concept that magnifies the growth of investments over time. Understanding its mechanisms and leveraging its potential can propel both personal and institutional financial success.

Unlike simple interest, which is calculated solely on the initial principal, compound interest grows exponentially as it accrues on both the initial principal and accumulated interest from previous periods.

This difference, while seemingly subtle, has profound implications for wealth generation and financial planning. At its core, the power of compound interest hinges on four key factors: the principal amount, the interest rate, the frequency of compounding, and the duration of the investment.

To truly grasp the potency of compound interest, one must consider these elements in tandem. For instance, even a modest principal can grow substantially with a favorable interest rate and frequent compounding over a prolonged period.

Mathematically, the compound interest formula \( A = P (1 + \frac{r}{n})^{nt} \) encapsulates these dynamics. Here, \( A \) represents the future value of the investment, \( P \) is the initial principal balance, \( r \) is the annual interest rate, \( n \) is the number of times interest is compounded per year, and \( t \) is the number of years the money is invested.

Through practical examples, one can visualize how incremental increases in any of these variables can amplify the final amount significantly. The long-term benefits of compound interest cannot be overstated.

For savers and investors alike, allowing investments to grow uninterrupted over many years can lead to substantial financial gains, a principle often advocated in retirement planning and educational savings. Strategies to maximize these benefits include starting early, contributing regularly, and opting for investments with higher compounding frequencies.

Selecting the appropriate financial products is essential. Instruments like high-yield savings accounts, certificates of deposit (CDs), and certain bonds take advantage of compound interest. Additionally, reinvesting dividends and choosing growth-oriented mutual funds or index funds can further leverage this powerful financial tool.

In conclusion, mastering the intricacies of compound interest can serve as a cornerstone of effective financial strategy, enabling individuals to harness the full potential of their savings and investments.

By understanding and applying the principles of compound interest, one can move closer to achieving long-term financial goals and securing a more prosperous future. Just as a snowball gathers more snow as it rolls downhill, investments leveraging compound interest can grow substantially, making the journey toward financial security smoother and more attainable.