The Impact of Quantitative Easing on Global Financial Markets: A Deep Dive

Uncover the far-reaching effects of Quantitative Easing on global financial markets. Explore its mechanics, implications, and consequences on national economies.

In the high-octane world of financial markets, the term Quantitative Easing (often abbreviated as QE) has become a staple topic of conversation. While it sounds esoteric, this unconventional monetary policy tool has had profound effects not only on national economies but also on the global financial landscape. To understand QE's influence, we must first dissect what it entails and the mechanics behind it.

What is Quantitative Easing?

Think of an economy as a vast, intricate machine with moving parts that include businesses, consumers, banks, and financial markets. Now, imagine the central bank as the mechanic tasked with keeping this machine running smoothly. Quantitative Easing is one of the specialized tools in their toolkit.

At its core, QE involves the central bank purchasing government securities or other financial assets from the market to inject liquidity directly into the economy. In simpler terms, it's akin to turning on a financial faucet, pouring money into the system to encourage lending and investment.

Why Implement QE?

Central banks resort to QE primarily during periods of economic distress, like the 2008 financial crisis or the COVID-19 pandemic. When traditional monetary policy tools, like lowering interest rates, hit their limits (known as the zero lower bound), QE becomes a viable alternative.

The objective is multi-fold:

- Boost economic growth by encouraging spending and investment.

- Combat deflationary pressures that can spiral an economy into a deeper recession.

- Lower long-term interest rates, making borrowing cheaper for businesses and consumers.

How Does QE Work?

When a central bank decides to implement QE, it buys financial assets, typically government bonds, from the open market. This purchasing spree leads to a couple of significant outcomes:

- Increase in Bank Reserves: Banks, now flush with new reserves, are more equipped to lend money. Imagine receiving a large cash deposit into your savings account; you're more likely to spend or invest some of it.

- Lower Interest Rates: The increase in demand for these securities drives their prices up and yields (interest rates) down. Remember, bond prices and yields have an inverse relationship—a foundational financial concept.

The Ripple Effect on Financial Markets

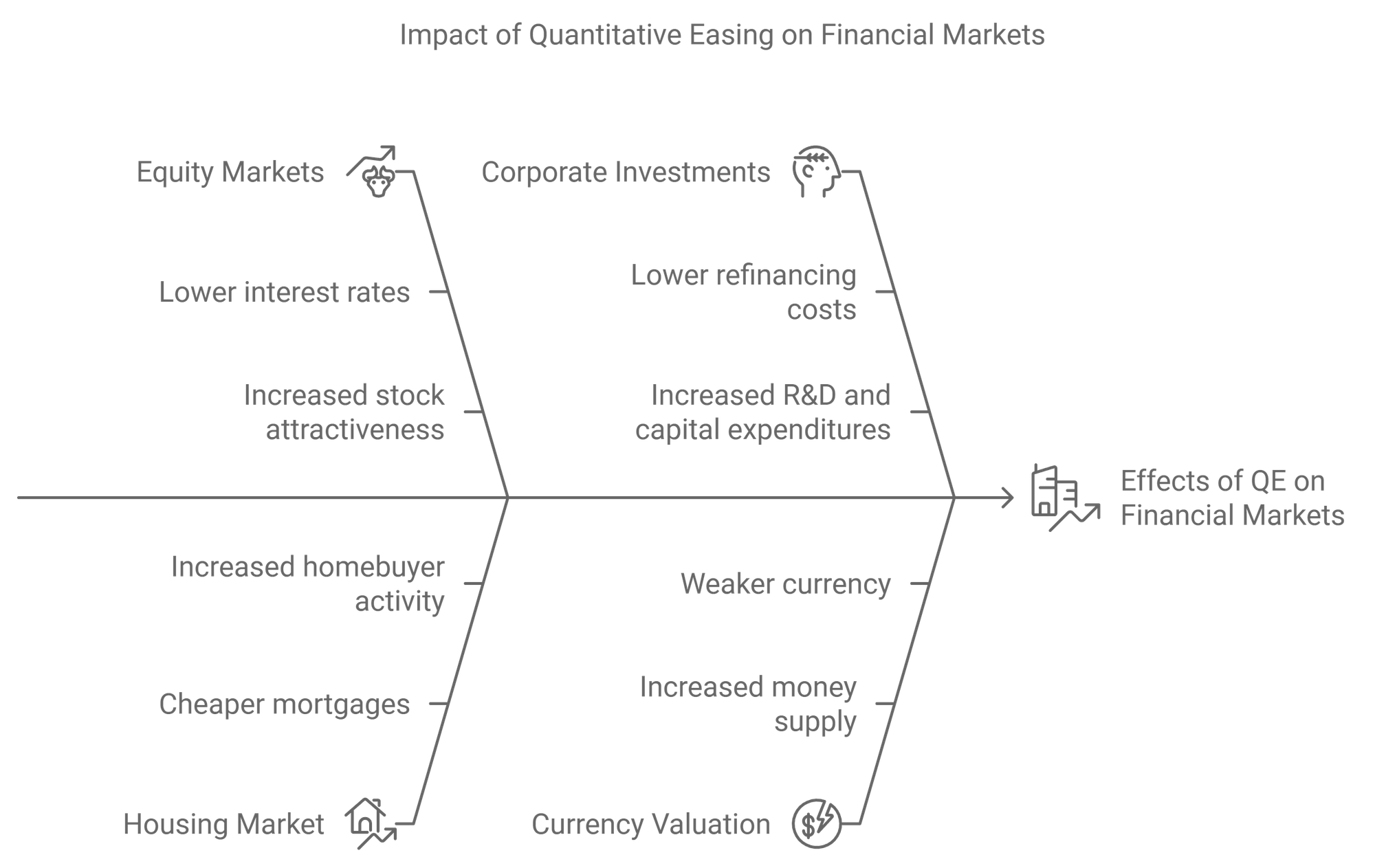

Understanding QE's impact requires us to follow the money's journey through the financial system:

- Equity Markets: Lower interest rates make stocks more attractive relative to bonds. Investors, seeking better returns, flood into equities, driving stock prices higher. This phenomenon was evident in the post-2008 bull market.

- Housing Market: Lower borrowing costs spurred by QE can ignite the housing market. Cheaper mortgages enable more people to buy homes, potentially driving prices up.

- Corporate Investments: Companies can refinance debt at lower costs and potentially invest more in growth initiatives, such as research and development (R&D) or capital expenditures.

- Currency Valuation: With more money circulating, the value of a country's currency can decrease relative to others. A weaker currency can benefit exporters by making their goods more competitively priced abroad.

Global Repercussions

The globalized nature of today's economy means QE's effects are not contained within national borders. Countries intertwined through trade and investment experience its reverberations. For instance:

- Emerging Markets: Nations reliant on foreign investment might see capital inflows as investors chase higher yields, sometimes causing asset bubbles.

- Trade Imbalances: Currency depreciation tactics can lead to competitive devaluations, influencing global trade dynamics.

- Cross-Border Investments: As QE lowers returns domestically, investors look globally for better opportunities, inadvertently soaring foreign markets.

Criticisms and Risks

No policy comes without scrutiny, and QE is no exception. Critics argue that QE can lead to asset bubbles, as cheap money chases limited investment opportunities. Moreover, QE disproportionately benefits those with significant financial assets, thus exacerbating wealth inequality.

Additionally, there's a concern about the exit strategy. Withdrawing QE without jolting the markets has proven to be a delicate balancing act, as evidenced by the taper tantrum of 2013, when mere hints of reducing bond purchases caused market volatility.

Conclusion

Quantitative Easing, while a potent tool for stabilizing and stimulating economies, remains a double-edged sword. Its intricate influence weaves through various facets of financial markets, literally reshaping the economic fabric. As global economies continue to navigate unprecedented challenges, understanding the dynamics and repercussions of QE becomes indispensable for policymakers, investors, and citizens alike.

While QE may appear as the central bank's magic wand for troubled times, it's essential to grasp its broader implications and tread cautiously to ensure that the short-term gains don't morph into long-term pitfalls.