The Art and Science of Diversification in Investment Portfolios

Master the art of diversification to balance risk and reward in your investment portfolio. Learn strategies to maximize returns and minimize losses.

Investing can often feel like a high-wire act, requiring a delicate balance between risk and reward. However, there's a strategy that can act like a safety net under this tightrope—diversification. This foundational principle of investing, championed both by financial theorists and seasoned market practitioners, aims to mitigate risk while maximizing potential returns.

In this article, we will delve deep into the art and science of diversification, unravel its benefits, and present a roadmap for constructing a well-diversified investment portfolio.

Understanding Diversification: The Concept Explained

Diversification is akin to not putting all your eggs in one basket. Essentially, it means spreading your investments across various asset classes, sectors, and geographical regions to reduce exposure to any single investment's risks. When one asset zigs, another might zag, thereby cushioning the overall portfolio from abrupt declines. The goal is not to eliminate risk entirely—that's impossible—but to manage it prudently.

The Rationale Behind Diversification

To understand diversification's rationale, imagine you're a farmer planting multiple crops. If a disease wipes out your corn, your wheat and soybeans might still thrive. Similarly, in an investment context, when one asset class underperforms, another might outperform, balancing the net effect on your investment returns. This interplay reduces the overall risk. Three core reasons underscore diversification's importance:

1. Risk Reduction

By spreading investments, the investor minimizes the impact of a poor performer on the whole portfolio. Different asset classes often have low or negative correlations, meaning they don't move in sync. Stocks and bonds, for instance, typically have an inverse relationship.

2. Return Enhancement

Diversification also provides potential for improved returns. By including a mix of asset types, investors can tap into the varying sources of performance from each class. This strategy ensures that they are not overly reliant on any single asset’s performance.

3. Smoothing Volatility

Market volatility can cause significant challenges for investors, particularly those nearing retirement. A diversified portfolio tends to be more stable over time, riding smoother waves compared to a portfolio concentrated in a single asset class.

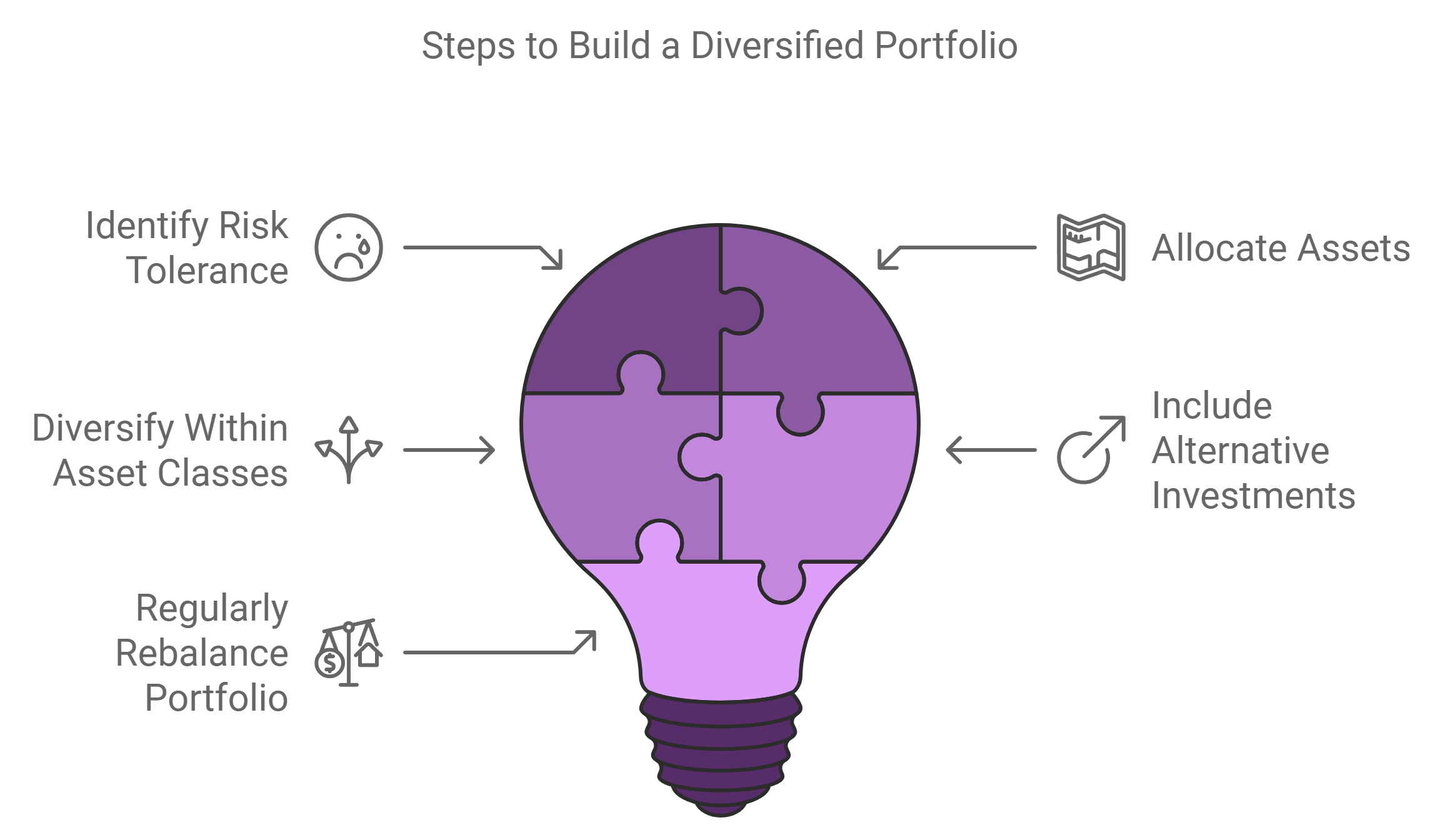

How to Diversify: A Step-by-Step Guide

Building a diversified portfolio might seem daunting, but breaking it down into steps can make the process manageable:

1. Identify Your Risk Tolerance

Every investor has a unique risk tolerance determined by factors such as age, financial goals, and investment time horizon. Younger investors might afford more risk, leaning towards equities, whereas older investors might prefer safer assets like bonds.

2. Allocate Assets

Asset allocation involves deciding how to distribute investments among different asset classes: stocks, bonds, real estate, and cash equivalents. This step is critical as it lays the foundation of your portfolio’s risk and return profile.

3. Diversify Within Asset Classes

Don't simply diversify among asset classes but also within them. For example, within equities, consider diversifying across different industries and geographies. This could mean owning shares in tech companies, healthcare firms, and consumer goods across various countries.

4. Include Alternative Investments

Alternative investments, such as commodities, hedge funds, or private equity, can add an additional layer of diversification due to their unique performance characteristics which often don’t correlate with traditional stocks and bonds.

5. Regularly Rebalance the Portfolio

Over time, some investments will perform better than others, skewing your original asset allocation. Regular rebalancing—buying and selling assets to return to your initial allocation—helps maintain your target risk level.

The Limitations and Challenges of Diversification

While diversification is a powerful tool, it’s not without limitations:

1. Over-Diversification

Too much diversification can dilute returns, as owning too many securities makes it challenging to outperform the market. It’s essential to strike a balance—owning enough securities to reduce risk, but not so many that managing them becomes cumbersome.

2. Not a Foolproof Strategy

Diversification cannot eliminate all risks, especially systemic risks like economic downturns that affect nearly all investments. Think of 2008's financial crisis; diversification couldn't shield portfolios from the market-wide meltdown.

3. Complexity and Costs

Managing a diversified portfolio requires ongoing monitoring and frequent transactions, which can incur higher costs. Furthermore, the complexity of understanding and executing diversification strategies may pose a challenge for individual investors.

Practical Examples of Diversified Portfolios

Let’s solidify our understanding with a few practical examples:

1. Conservative Portfolio

A retired individual seeking stability might have a portfolio consisting of 60% bonds, 30% stocks, and 10% cash equivalents. This composition aims for steady income with minimal risk.

2. Balanced Portfolio

A mid-career professional might opt for a balanced portfolio with 50% stocks, 30% bonds, 10% real estate, and 10% in commodities. This setup seeks a mix of growth and income.

3. Aggressive Portfolio

A young investor with a long time horizon might favor 70% stocks, with remaining allocations split between international equities and high-yield bonds. This allocation aims for significant growth, accepting higher risk and volatility.

Conclusion: The Ongoing Journey of Diversification

Diversification is not a one-time event but an ongoing journey. It requires continuous learning, vigilance, and adjustments to navigate ever-changing market conditions. Think of it as financial insurance, a proactive approach to weathering the inevitable storms of the investment world.

By employing the principles of diversification, investors can aim to safeguard their portfolios, positioning themselves to achieve their long-term financial goals with more confidence and less anxiety.