Straightforward Techniques for Effective Debt Reduction

Debt can feel overwhelming, overshadowing your finances and peace of mind. However, reducing debt involves simple strategies that can restore control and lead to financial freedom.

Debt can feel like a towering mountain, casting a shadow over your financial landscape. For many, it's a burden that seems insurmountable, draining both bank accounts and peace of mind. Yet, just as the most complex algorithm can be broken down into simpler steps, the path to debt reduction is often paved with straightforward techniques. Mastering these effective strategies is crucial—not only for achieving financial freedom but for regaining a sense of control over one’s financial future.

The importance of debt reduction cannot be overstated. The average American household carries around $137,063 in debt, according to the Federal Reserve. This isn’t merely a matter of numbers; it’s a stressor that impacts daily lives, relationships, and even health. Decreasing this weight can usher in not just fiscal stability, but also emotional and mental well-being. Our focus here is on simplifying the complex world of debt reduction into digestible, actionable methods.

You don’t need to be a financial guru to start, but understanding and applying these straightforward debt reduction techniques can set you on the right path. Imagine your debt as a sprawling, overgrown garden. By systematically trimming away the excess and managing what's left efficiently, you can transform it into a manageable plot of land. In the sections that follow, we will dissect the most effective strategies for debt reduction.

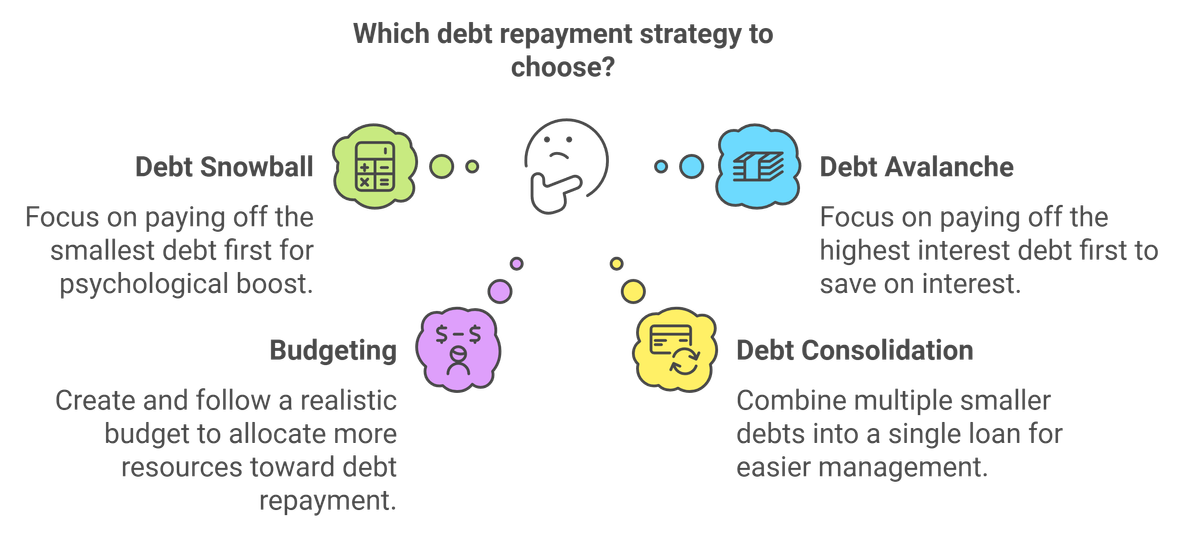

Whether it's adopting the Snowball Method—paying off smaller debts first to build momentum—or leveraging the Avalanche Method, which prioritizes higher interest rates, these strategies are designed to simplify your journey. We will also explore the significance of a realistic budget, a tool as critical as a map in uncharted territory. Furthermore, maintaining financial discipline is key. Cutting unnecessary expenses, looking into debt consolidation options, and seeking professional financial advice are but a few of the ways you can keep your financial house in order.

By the end of this guide, you will not only have a clearer picture of your debt but also the tools to manage and reduce it effectively. In sum, navigating through debt may feel overwhelming, but by employing straightforward debt reduction techniques, you can reclaim control and set a course for a debt-free future.

Introduction to Straightforward Debt Reduction Techniques

Debt can often feel like a heavy anchor holding you back from financial freedom. It tethers families and individuals in a cycle of payments that can last for years if not managed effectively. Therefore, understanding the importance of straightforward debt reduction techniques is crucial for anyone looking to regain control over their finances.

Why is debt reduction so important?

First, debt reduction is critical because debt, especially high-interest debt, can erode your net worth over time. The magic of compound interest works both ways: while it can help your investments grow, it can also make your debt multiply if left unchecked. According to a report by the Federal Reserve, the average American household carries a credit card debt of approximately $6,194. Imagine a snowball rolling down a hill: as it rolls, it gathers more snow and grows larger. Debt can accumulate similarly, making it crucial to nip it in the bud before it becomes unmanageable.

So, what are these straightforward debt reduction techniques? Much like using a well-structured map to navigate your way through unfamiliar territory, these techniques offer clear, actionable steps to help you pay down debt and achieve financial stability. We will touch upon some of these pivotal strategies to help you move in the right direction.

Importance of Debt Reduction

Managing debt should be as much a part of personal finance planning as saving and investing. High debt levels can have several adverse impacts, including a lower credit score and higher stress levels. A poor credit score, in turn, affects your ability to secure loans for significant life events, such as purchasing a home or a car. Furthermore, FICO, the major credit scoring company, indicates that credit utilization—which accounts for 30% of your credit score—is heavily influenced by outstanding debt.

Moreover, high debt levels often come with high-interest rates. According to CreditCards.com, the average APR on credit card debt exceeds 16%. This means that every dollar of credit card debt could end up costing you much more in interest if you only make minimum payments. Imagine rowing a boat with a hole in it: you could be paddling as hard as you can, but water keeps filling up, making it hard to move forward. Similarly, paying only the minimum amount each month keeps you from making meaningful progress in reducing your debt.

Overview of Straightforward Techniques

Now that we’ve illustrated the importance of reducing debt, let’s delve into some methods considered straightforward but highly effective. Think of these techniques as your toolkit, each designed for specific situations, but all aimed at chiseling away your debt, much like a sculptor with a block of marble.

Debt Snowball Method: This technique involves focusing on paying off your smallest debt first while making minimum payments on the larger ones. Once the smallest debt is cleared, you move on to the next smallest, gradually working your way up. The sense of accomplishment from paying off smaller debts acts as a psychological booster, making it easier to stick to your repayment plan. Personal finance guru Dave Ramsey is a major proponent of this method.

Debt Avalanche Method: This strategy is a bit different; here, you concentrate on paying off the debt with the highest interest rate first, while making minimum payments on the others. Once the highest interest debt is paid off, you move to the next highest. While it might take longer to gain a psychological win, this method saves you more money in interest payments over time. Experts like Suze Orman often recommend this approach for its efficiency in minimizing interest costs.

Creating and Following a Realistic Budget: A budget acts as the blueprint for your financial plan. It helps you understand where your money is going and identify areas where you can cut back. By listing all your expenses and comparing them against your income, you can allocate more resources toward debt repayment. According to a study published by the University of Cambridge, individuals who budget tend to manage their debt better than those who do not.

Debt Consolidation: This method involves combining multiple smaller debts into a single loan, often at a lower interest rate. By doing so, you simplify your payments and can often reduce your overall monthly repayment amount. According to the Consumer Financial Protection Bureau (CFPB), consolidating debt can make it easier to manage and pay off, provided you don’t accumulate new debt in the meantime.

Utilizing these straightforward debt reduction techniques can pave the way for financial stability and independence. Much like a well-orchestrated symphony, each method harmonizes to create a cohesive action plan. Implementing these strategies requires discipline, perseverance, and a clear understanding of your financial situation. But take heart, the journey of a thousand miles begins with a single step, and by taking these initial steps, you can steadily work towards a debt-free future.

Wall Street Simplified (@WSSimplified)

Proven Strategies for Effective Debt Reduction

Adopting the Snowball Method

The snowball method is one of the most popular and straightforward debt reduction techniques. This strategy involves focusing on paying off the smallest debt first while maintaining minimum payments on your other debts. The psychology behind this method is similar to how a snowball gains momentum as it rolls down a hill. By quickly eliminating smaller debts, you build up emotional and mental satisfaction, encouraging continued progress.

Financial expert Dave Ramsey has been a strong advocate of the snowball method, often stating, “Personal finance is 80% behavior and 20% head knowledge.” Ramsey's approach is grounded in the belief that small victories can fuel a stronger drive to tackle larger financial challenges. Data supports this—research from the Kellogg School of Management found that people who used the snowball method were more likely to become debt-free sooner than those using other methods.

For example, consider someone with four debts totaling $20,000: $500 on a credit card, $1,500 in healthcare bills, $5,000 on a personal loan, and $13,000 in student loans. Using the snowball method, they would first focus on the $500 credit card debt. By directing all available funds to this small debt while making minimum payments on the other three, they’d quickly achieve a win. This victory reinforces the individual's confidence and propels them toward tackling the larger debts.

Utilizing the Avalanche Method

While the snowball method motivates through quick wins, the avalanche method takes a different approach by focusing on minimizing the total interest paid over time. This technique targets debts with the highest interest rates first, regardless of the balance size. Think of it like an avalanche that starts at the peak: addressing the highest point of interest allows for a progressive, downward financial impact.

Consider another scenario with the same four debts totaling $20,000: a credit card at 20% interest, healthcare bills at 5%, a personal loan at 10%, and student loans at 6%. Using the avalanche method, you’d focus on the credit card debt first, since it accrues interest the fastest. By directing funds to the highest-interest debt, you're essentially reducing the weight of your debt snowfield, preventing it from growing uncontrollably. Economists often highlight the math behind the avalanche method as superior for saving money in the long run. According to a study published in the American Economic Review, those who employed the avalanche method experienced an approximate 5-10% saving on interest compared to the snowball method over their debt repayment journey.

Creating and Following a Realistic Budget

A realistic budget acts as the blueprint for successful debt reduction, integrating seamlessly with either the snowball or avalanche methods. Think of budgeting as the steady current that gently steers you along the path to financial freedom. Creating a budget involves listing all your sources of income, categorizing your monthly expenses, and identifying areas where you can cut back.

For instance, if your monthly take-home pay is $4,000 and your expenses total $3,500, you have $500 left to allocate toward debt repayment. Experts recommend the 50/30/20 rule: allocate 50% of your income to necessities such as rent and groceries, 30% to non-essentials like dining out and entertainment, and 20% to savings and debt repayment. By adhering to these percentages, you ensure a balanced financial lifestyle while systematically addressing your debts.

The success of a budget hinges on its realism. Prominent financial advisor Suze Orman emphasizes, A big part of financial freedom is having your heart and mind free from worry about the what-ifs of life. Her guidance underscores the importance of setting achievable targets and maintaining flexibility in your financial plan. For example, if you find that an unexpected expense like a car repair derails your monthly budget, instead of abandoning your plan, adjust it.

Reallocate funds temporarily from the non-essential spending category to cover the emergency, then refocus on your debt reduction goals once the crisis passes. Integrating regular reviews into your budgeting process is crucial. Monthly financial check-ups allow you to track your progress, adjust your categories, and ensure you stay on course. Incorporate these reviews into a personal finance routine, perhaps setting aside time on the last weekend of each month to reconcile your expenditures and reassess your goals.

Both the snowball and avalanche methods benefit greatly from a supportive budget, laying the groundwork for effective debt reduction. Adopting one of these models, supported by a well-crafted budget, can transform a daunting financial challenge into a manageable, step-by-step journey toward freedom from debt. Wall Street Simplified (@WSSimplified)

Cutting Unnecessary Expenses

At the heart of maintaining financial discipline lies a simple yet powerful habit: cutting unnecessary expenses. Imagine your budget as a leaky boat. Every unnecessary expense is a hole that's slowly but surely sinking you deeper into debt. By identifying and plugging these holes, you can stay afloat and eventually sail towards financial stability. It might seem daunting at first, but taking small, consistent steps can lead to big changes over time.

A good starting point is to meticulously track your spending. Tools like expense trackers or budgeting apps can help illuminate where your money is going. According to data from the U.S Bureau of Labor Statistics, Americans spend, on average, $3,000 annually on dining out and entertainment. Simple changes, like cooking at home more frequently and finding free or low-cost entertainment options, can result in significant savings. For instance, a family cutting their dining-out expenses by just 50% could save around $1,500 a year.

Moreover, subscriptions and memberships often go unnoticed. A survey by West Monroe found that the average consumer underestimates their subscription costs by nearly $133 per month. Assessing and canceling subscriptions you barely use can free up substantial sums for debt repayment. Cancelling a seldom-used gym membership and switching to home workouts, for example, not only saves money but also offers personal convenience.

Ultimately, adopting a frugal lifestyle doesn't mean sacrificing all pleasures; it’s about prioritizing needs over wants. Renowned financial advisor Dave Ramsey underscores this, stating, “A budget is telling your money where to go instead of wondering where it went”. By being intentional with your spending, you set yourself up for sustainable debt reduction, making financial discipline a cornerstone of your strategy.

Exploring Debt Consolidation Options

Debt consolidation is another powerful tool in the arsenal of straightforward debt reduction techniques. Picture your debts as individual pieces of a jigsaw puzzle scattered across the table. Debt consolidation gathers these pieces into one coherent frame, simplifying the often overwhelming process of managing multiple loans. By consolidating, you roll all your high-interest debts into a single, lower-interest loan, making it easier to handle and potentially reducing the total amount of interest paid over time.

There are several debt consolidation options to consider. Personal loans, balance transfer credit cards, and home equity loans are some of the popular avenues. For instance, a balance transfer credit card can be an excellent option if you have multiple high-interest credit card debts. Many balance transfer cards offer a 0% introductory APR for a specified period, typically between 12 and 18 months. By consolidating onto such a card, you can pay down the principal more quickly without accruing additional interest.

Consider the case of Mark, who had $15,000 spread across three credit cards with an average interest rate of 20%. By transferring his balances to a card with a 0% APR for 15 months and paying $1,000 monthly, Mark was able to pay off his debt before the promotional period ended, saving over $1,800 in interest payments.

However, it's essential to ensure that you don't rack up more debt after consolidating. Debt consolidation should be part of a broader debt reduction strategy that includes disciplined spending and a commitment to not accruing future debt. The insights of financial luminaries like Suze Orman stress this point. Orman advises, “Debt consolidation isn't a magic bullet. The key is to address the behaviour that caused the debt in the first place.”

Seeking Professional Financial Advice

When DIY efforts to achieve financial discipline seem overwhelming, seeking professional financial advice can be an excellent option. Think of professional financial advisors as seasoned navigators for a ship lost at sea. These experts analyze your financial situation holistically and provide tailored, objective advice to steer you towards debt-free waters.

A certified financial planner (CFP) or a credit counselor can offer a wealth of knowledge. Depending on their specialty, financial advisors can help you create a viable debt repayment plan, suggest investment opportunities that dovetail with your financial goals, and provide advice on budgeting and expense management. For example, a CFP might offer insights on managing both current debt and retirement planning, ensuring a long-term, holistic approach to financial health.

Credit counseling agencies, often non-profit organizations, offer specific services like debt management plans (DMPs). With a DMP, the agency negotiates lower interest rates or monthly payments with creditors on your behalf. According to the National Foundation for Credit Counseling, clients enrolled in DMPs typically see their interest rates reduced by an average of 6-8% and often become debt-free in 3-5 years.

But choosing the right advisor is crucial. Ensure they are reputable and credentialed, such as being certified by recognized bodies like the Financial Planning Association (FPA) or the National Association of Personal Financial Advisors (NAPFA). It’s also wise to verify if they adhere to a fiduciary standard, meaning they are legally required to act in your best interest.

In summary, maintaining financial discipline encompasses more than just following a budget or cutting expenses. It involves strategic actions like debt consolidation and, when necessary, seeking the wisdom of financial professionals. By incorporating these straightforward debt reduction techniques, individuals can not only manage but also overcome debt, setting the stage for a secure financial future.

Debt reduction, while often viewed through the prism of austerity, is fundamentally an exercise in sustainable financial management. The techniques discussed—be it the Snowball or Avalanche methods—offer structured and psychologically savvy pathways to chip away at burdensome liabilities. These methods, named for their evocative analogies, provide tangible steps that individuals can follow to create long-term stability.

It’s akin to how a mountaineer tackles a peak: each step methodically planned, cognizant that the summit is the culmination of many incremental advancements. The Snowball method, with its psychological ease, focuses on tackling smaller debts first. Its strength lies in the power of momentum, akin to small victories building confidence and fostering a sense of progress. Conversely, the Avalanche method, which puts the emphasis on high-interest debts, can substantially lower the overall interest paid, making it a potent tool for those disciplined enough to stay the course.

Both strategies demand rigor and resilience, illustrating the duality of debt reduction—balancing short-term tactics with long-term rewards. Supplementing these foundational techniques are budget creation and adherence strategies that funnel one’s financial resources efficiently. A well-constructed budget acts as a financial compass, guiding decisions and illuminating areas where cutbacks are feasible. It's about reallocating resources wisely, much like a savvy gardener prunes and nurtures plants to yield a thriving garden.

Cutting unnecessary expenses—a pragmatic yet crucial step—can reveal otherwise obscured financial bandwidths. For those grappling with overwhelming debt, consolidation can offer a sanctuary, merging multiple debts into a single, often lower-interest payment plan. This method isn't a panacea but a bridge to more manageable finances, akin to refinancing a home mortgage. Professional financial advice remains an invaluable asset, especially when navigating more complex financial terrain. Financial advisors can offer bespoke strategies and provide accountability, much like a personal trainer in the gym.

The essence of debt reduction lies in its straightforwardness—structured plans, disciplined execution, and the willingness to adjust when necessary. The journey can be arduous, demanding both tactical savvy and emotional fortitude. However, the reward—financial freedom and peace of mind—is a summit worth striving for. By embracing proven techniques and maintaining strict financial discipline, individuals can untangle themselves from the grip of debt, setting the stage for a more secure and prosperous future.